Sales Tax In Vegas: The Ultimate Guide To Understanding And Maximizing Your Savings

Welcome to the wild world of Sin City, where the glitz, glam, and tax rates all meet! If you're planning a trip to Las Vegas or running a business in the area, understanding sales tax in Vegas is crucial. It's not just about the lights and casinos; it's also about knowing how much you're really spending. So, buckle up, because we're diving deep into the realm of sales tax in Las Vegas!

Las Vegas is more than just a playground for adults. It's a city where every dollar counts, and understanding sales tax can help you stretch your budget further. Whether you're a tourist looking to shop or a local business owner trying to stay competitive, this guide will break it down for you.

Here's the deal: sales tax is something everyone deals with, but not everyone understands. In Vegas, the tax rate can vary depending on what you're buying and where you're buying it. So, let's get into the nitty-gritty and uncover the secrets of sales tax in Vegas!

- Unlocking The Secrets Of Free Website Rank A Comprehensive Guide

- Discovering Your Digital Footprint How To Find My Rank On Google

What Exactly Is Sales Tax in Vegas?

Sales tax in Vegas is essentially a percentage charged on goods and services. Think of it as the city's way of keeping the lights on and the shows running. But here's the kicker: the tax rate isn't the same everywhere. It depends on the type of transaction and the location.

How Does It Work?

When you buy something in Vegas, the sales tax is added to the price. For example, if you're buying a souvenir for $20 and the sales tax is 8.38%, you'll end up paying around $21.68. It may not seem like much, but those pennies add up quickly!

- Retail purchases are subject to sales tax.

- Some services, like hotel stays, have their own tax rates.

- Tax rates can vary by county and city.

Current Sales Tax Rates in Las Vegas

As of 2023, the general sales tax rate in Las Vegas is 8.38%. This includes:

- Mastering Your Online Presence How To Check My Google Search Ranking

- Discovering Your Digital Standing How To Check Ranking Of A Website

- State tax: 6.85%

- Clark County tax: 1.13%

- Local option tax: 0.40%

But wait, there's more! Certain items, like cars and luxury goods, may have additional taxes. And if you're staying in a hotel, get ready for an extra 13% room tax on top of the regular sales tax.

Why Does Sales Tax Matter in Vegas?

Vegas is all about spending, but understanding sales tax can help you save. Whether you're a tourist or a local, knowing the tax rates can help you budget better. Plus, if you're running a business, you need to make sure you're charging the right amount of tax to avoid legal trouble.

Impact on Tourists

For tourists, sales tax can be a hidden cost. Imagine buying a fancy outfit for a night out, only to realize the final price is much higher than expected. That's why it's important to factor in sales tax when planning your Vegas budget.

Impact on Businesses

Business owners in Vegas need to stay on top of sales tax regulations. Failing to collect the right amount of tax can lead to fines and legal issues. Plus, offering tax-free promotions can be a great way to attract customers.

History of Sales Tax in Las Vegas

Sales tax has been a part of Las Vegas since the early days. Back in the 1950s, the tax rate was much lower, but as the city grew, so did the need for revenue. Today, sales tax is a major source of income for the city, funding everything from schools to infrastructure.

How Has It Evolved?

Over the years, sales tax rates in Vegas have fluctuated. Economic downturns and booms have led to changes in the tax structure. For example, during the Great Recession, the tax rate was temporarily increased to help balance the budget.

Common Misconceptions About Sales Tax in Vegas

There are a lot of myths floating around about sales tax in Vegas. Let's bust a few of them:

- Myth 1: Everything in Vegas is tax-free. Nope! While there are some tax-free items, most purchases are subject to sales tax.

- Myth 2: Tourists don't have to pay sales tax. Sorry, but everyone has to pay sales tax, regardless of where they're from.

- Myth 3: Sales tax is the same everywhere in Nevada. Wrong! Tax rates can vary by county and city.

Tips for Managing Sales Tax in Vegas

Now that you know the basics, here are some tips to help you manage sales tax in Vegas:

- Shop during tax-free holidays if possible.

- Keep receipts for all purchases to track your spending.

- Use tax calculators to estimate your final costs.

For Tourists

As a tourist, you can save money by planning your purchases carefully. Look for sales and discounts, and try to shop at stores with lower tax rates.

For Businesses

Business owners should stay up-to-date with tax laws and regulations. Consider hiring a tax professional to ensure compliance and explore ways to minimize tax liabilities.

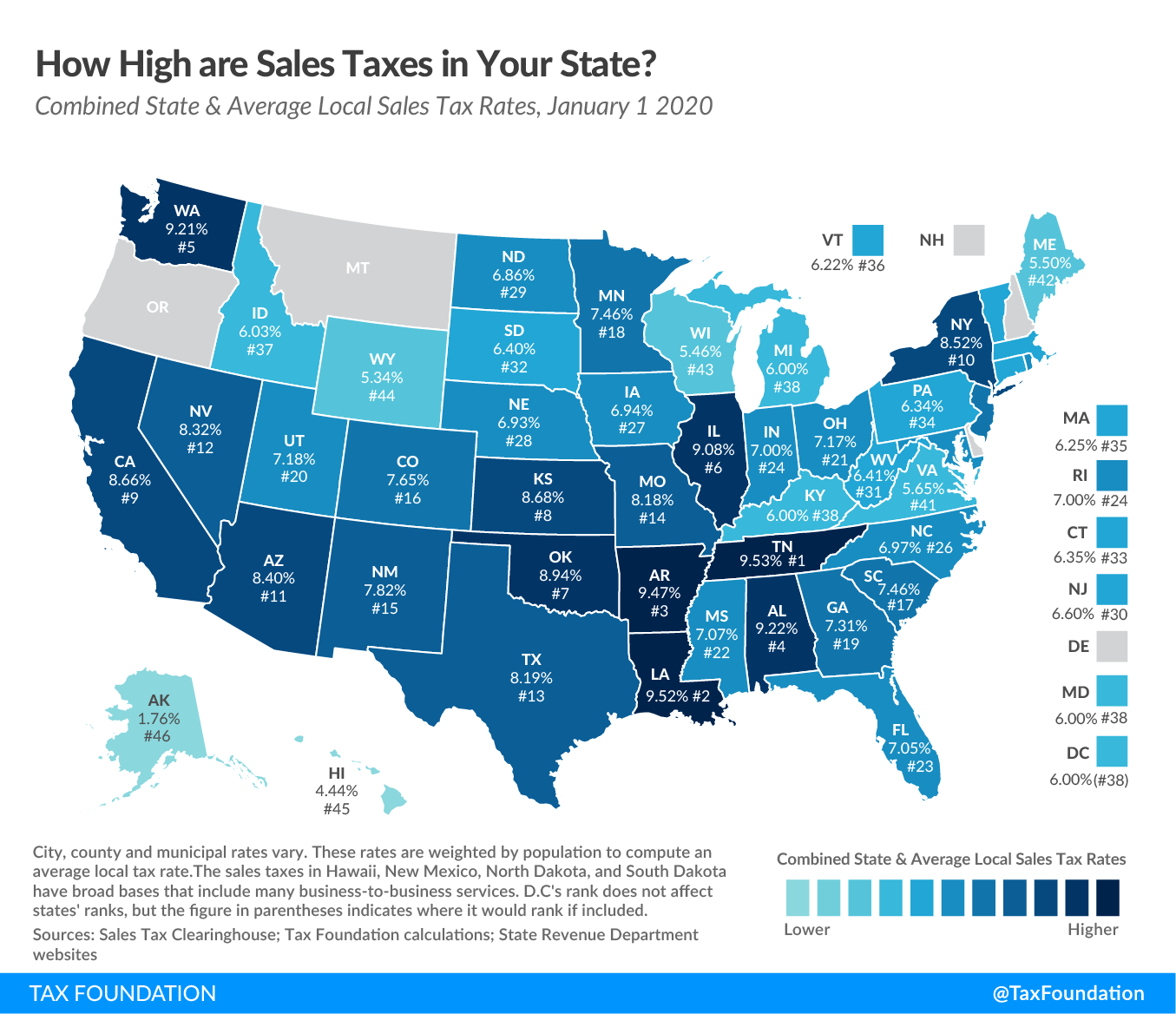

Comparing Sales Tax in Vegas to Other Cities

Las Vegas isn't the only city with sales tax, but its rates are higher than some other places. For example, the sales tax rate in Reno is slightly lower, while in California, rates can be even higher. Understanding these differences can help you make informed decisions when traveling or doing business.

Why Is Vegas Different?

Vegas relies heavily on tourism and hospitality, so the tax structure reflects that. Higher tax rates help fund the city's attractions and infrastructure, making it a more appealing destination for visitors.

Future of Sales Tax in Vegas

As the city continues to grow, sales tax rates may change. Economic factors, political decisions, and public demand can all influence the future of sales tax in Vegas. Keep an eye on local news and updates to stay informed.

Possible Changes

There's talk of introducing new tax incentives for businesses and possibly adjusting rates for certain items. While nothing is set in stone, it's worth keeping an ear to the ground.

Conclusion: Mastering Sales Tax in Vegas

Understanding sales tax in Vegas is key to making the most of your time in the city. Whether you're a tourist or a local, knowing the rates and regulations can help you save money and avoid headaches.

So, here's what you need to remember:

- Sales tax in Vegas is currently 8.38%.

- Hotel stays have an additional 13% tax.

- Stay informed about changes and updates.

Now that you're armed with knowledge, go out there and conquer Vegas! Don't forget to share this article with your friends and leave a comment below. And if you're looking for more tips and tricks, check out our other articles. Happy shopping!

Table of Contents

- What Exactly Is Sales Tax in Vegas?

- Current Sales Tax Rates in Las Vegas

- Why Does Sales Tax Matter in Vegas?

- History of Sales Tax in Las Vegas

- Common Misconceptions About Sales Tax in Vegas

- Tips for Managing Sales Tax in Vegas

- Comparing Sales Tax in Vegas to Other Cities

- Future of Sales Tax in Vegas

- Conclusion: Mastering Sales Tax in Vegas

- Unveiling The Truth Is Chris Perfetti Gay

- Unlocking Your Websites Visibility How To Check Your Website Ranking In Google

Las Vegas Sales Tax 2025 Robert Edward

Sales Tax In Las Vegas Nevada

Sales Tax In Las Vegas 2019