Is 740 FICO Score Good? Here's What You Need To Know

So, you're probably wondering if a 740 FICO score is actually good, right? Well, buckle up because we're diving deep into the world of credit scores, and trust me, it's not as boring as it sounds. Imagine your credit score as a report card for your financial behavior – and guess what? A 740 is like getting an A+ in some cases. But is it good enough? That's the million-dollar question we're about to answer.

Having a solid understanding of your FICO score is crucial, especially in today's economy. Whether you're planning to buy a house, get a car loan, or even apply for a credit card, your credit score plays a huge role in determining your financial future. And let's face it, nobody wants to be stuck with high interest rates or denied loans because of a low score.

Now, before we dive into the nitty-gritty details, let me just say this – a 740 FICO score is definitely something to be proud of. But is it good enough to get you the best deals? Let's find out as we break it down step by step. So, grab a coffee, sit back, and let's unravel the mystery of the 740 FICO score together.

Understanding Your FICO Score

What Exactly is a FICO Score?

A FICO score is like the financial version of your reputation. It's a three-digit number that lenders use to assess how likely you are to pay back your debts. Think of it as a snapshot of your creditworthiness at a particular moment in time. Your FICO score ranges from 300 to 850, with higher numbers indicating better creditworthiness.

Now, here's the kicker – a 740 FICO score falls into the "Very Good" category. But what does that mean in real-world terms? Well, it means you're in the top 20% of all consumers, which is pretty impressive if you ask me. Lenders will definitely take notice, and you'll likely qualify for some of the best interest rates and loan terms available.

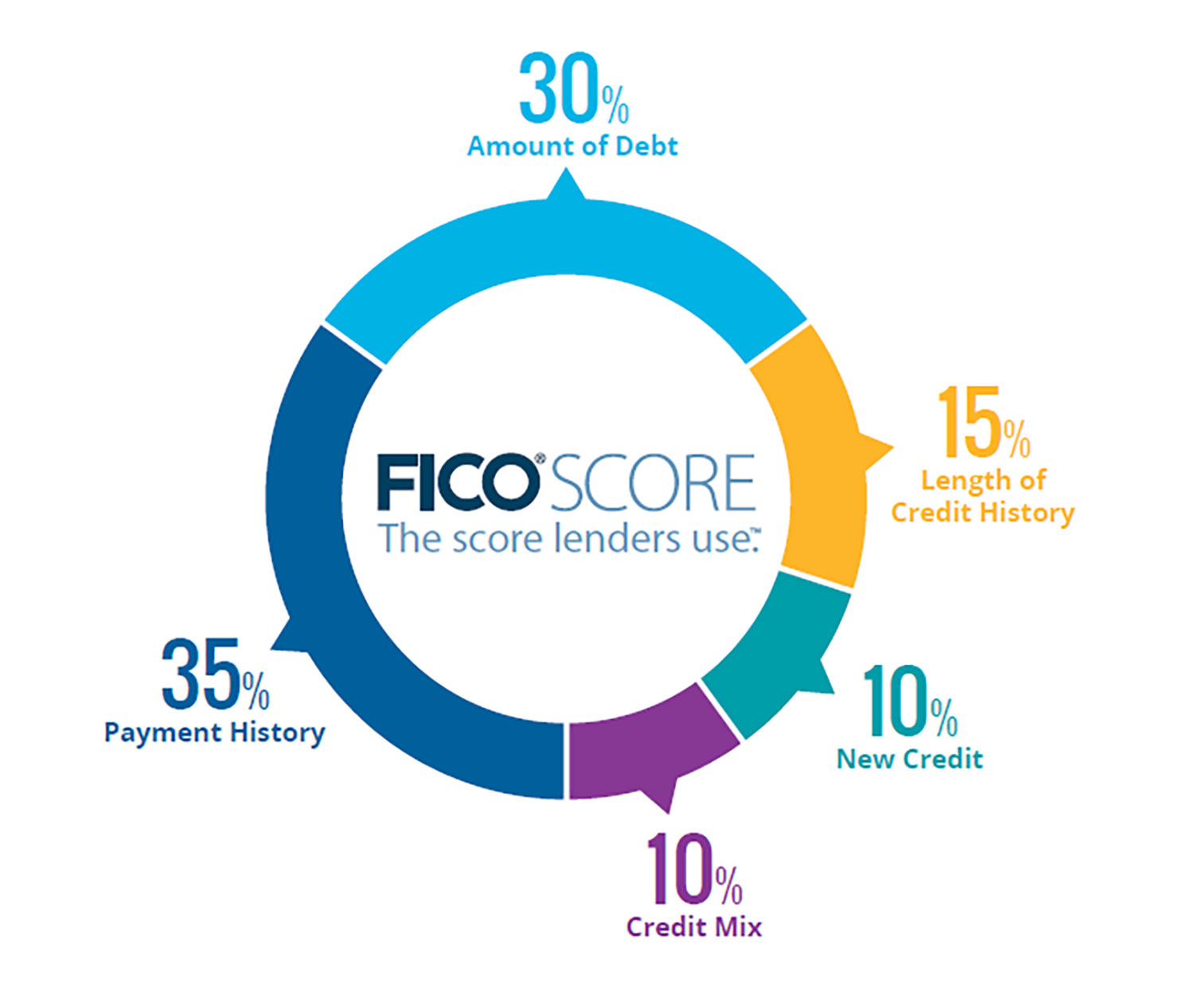

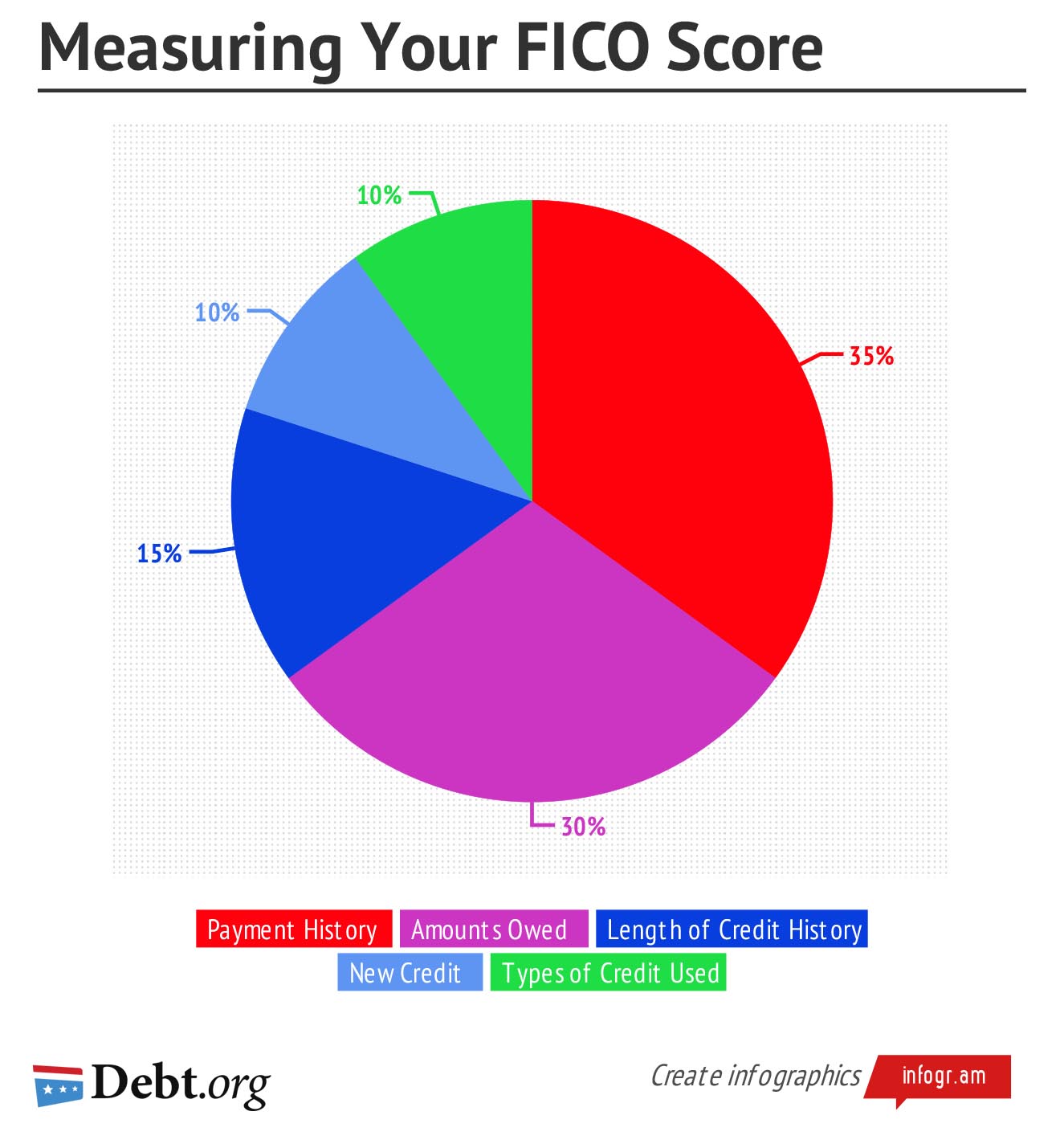

But wait, there's more! Your FICO score isn't just a random number. It's calculated based on several factors, including your payment history, credit utilization, length of credit history, and types of credit you have. Each of these factors plays a role in determining your overall score. So, if you're aiming for that perfect 850, you'll need to focus on improving each of these areas.

- Finding Your Place Where Do I Rank On Google

- Unlocking The Secrets Of Ranking Web Google For Your Website

Why is a 740 FICO Score Considered Good?

Breaking Down the Categories

When it comes to credit scores, there are five main categories: Poor, Fair, Good, Very Good, and Exceptional. A 740 FICO score lands you squarely in the "Very Good" category, which means you're doing better than most people. But what makes it so special?

Well, for starters, a 740 score gives you access to some of the best financial products on the market. You'll likely qualify for lower interest rates on mortgages, car loans, and credit cards, which can save you thousands of dollars over time. Plus, you'll have more negotiating power when it comes to loan terms and conditions.

Another benefit of having a 740 FICO score is that it shows lenders you're responsible with credit. You've likely been paying your bills on time, keeping your credit utilization low, and managing your debt wisely. All of these factors contribute to your overall score and make you a more attractive borrower.

How Does a 740 FICO Score Compare to Others?

The Credit Score Spectrum

Let's take a moment to compare a 740 FICO score to other scores on the spectrum. On one end of the scale, you have scores below 580, which are considered "Poor." These scores often result in higher interest rates, limited credit options, and difficulty getting approved for loans.

In the middle, you have scores ranging from 580 to 669, which are classified as "Fair." While these scores are better than "Poor," they still come with some limitations. You may qualify for credit, but the terms won't be as favorable as those offered to people with higher scores.

Now, let's talk about "Good" scores, which range from 670 to 739. These scores indicate that you're managing your credit responsibly, and you'll likely qualify for a wider range of credit products. However, you may not get the best rates or terms compared to those with "Very Good" or "Exceptional" scores.

Finally, we have the "Very Good" category, where a 740 FICO score resides. This category includes scores ranging from 740 to 799, and it's where you'll find the most favorable credit terms and lowest interest rates. If you're aiming for financial success, this is the category you want to be in.

What Can You Achieve with a 740 FICO Score?

Unlocking Better Financial Opportunities

With a 740 FICO score, you're in a great position to take advantage of some amazing financial opportunities. For starters, you'll likely qualify for the best mortgage rates, which can save you tens of thousands of dollars over the life of your loan. Imagine being able to afford your dream home without breaking the bank – sounds pretty good, right?

But it doesn't stop there. A 740 score also opens up doors to better car loan rates, lower credit card interest rates, and even better insurance premiums. You'll also have more negotiating power when it comes to credit limits and other financial products. In short, a 740 FICO score gives you the freedom to make smarter financial decisions.

And let's not forget about the peace of mind that comes with having a high credit score. Knowing that you're in good financial standing can reduce stress and give you the confidence to pursue your financial goals. Whether you're planning to start a business, invest in real estate, or save for retirement, a 740 FICO score can help you achieve your dreams.

How to Improve Your FICO Score Beyond 740

Tips for Boosting Your Credit Score

If you're already at a 740 FICO score, congratulations! But if you're looking to take it to the next level, here are a few tips to help you boost your score even further:

- Pay your bills on time – Payment history accounts for 35% of your FICO score, so making timely payments is crucial.

- Keep your credit utilization low – Aim to use no more than 30% of your available credit. Lower utilization can help improve your score.

- Monitor your credit report – Regularly check your credit report for errors or discrepancies that could be affecting your score.

- Use a mix of credit types – Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can improve your score.

- Be patient – Building a great credit score takes time, so don't get discouraged if you don't see immediate results.

By following these tips, you can gradually increase your FICO score and move closer to that elusive 850. Remember, even small improvements can make a big difference in your financial future.

Common Misconceptions About Credit Scores

Busting Credit Score Myths

There are a lot of myths and misconceptions surrounding credit scores, and it's important to separate fact from fiction. Here are a few common myths to be aware of:

- Checking your credit score will hurt it – This is false. Checking your own credit score is considered a soft inquiry and does not affect your score.

- Closing old credit accounts will improve your score – Actually, closing old accounts can hurt your score by reducing your credit history and increasing your credit utilization.

- Having a high income guarantees a good credit score – While income can affect your ability to pay bills, it's not a direct factor in calculating your FICO score.

By understanding these myths, you can make more informed decisions about your credit and avoid common pitfalls that could harm your score.

Real-Life Examples of 740 FICO Score Benefits

Success Stories from People with High Credit Scores

Let's take a look at some real-life examples of how a 740 FICO score can benefit you:

Sarah, a 35-year-old marketing executive, recently purchased her first home with a 740 FICO score. Thanks to her excellent credit, she was able to secure a 30-year fixed-rate mortgage at just 3.5%, saving her thousands of dollars in interest over the life of the loan.

Meanwhile, John, a 42-year-old IT professional, used his 740 FICO score to negotiate a lower interest rate on his car loan. By showcasing his strong credit history, he was able to reduce his monthly payments and save money in the long run.

These stories illustrate the real-world impact of having a high credit score. Whether you're buying a home, financing a car, or applying for a credit card, a 740 FICO score can make all the difference.

Conclusion: Is 740 FICO Score Good?

In conclusion, a 740 FICO score is definitely considered good, and it opens up a world of financial opportunities. From better mortgage rates to lower credit card interest, having a high credit score can save you money and give you more financial freedom. But remember, there's always room for improvement. By following the tips we've discussed, you can continue to build your credit and work towards that perfect 850.

So, what are you waiting for? Take control of your financial future and start working on improving your credit score today. And don't forget to share this article with your friends and family – knowledge is power, and the more people understand credit scores, the better off we'll all be. Thanks for reading, and good luck on your financial journey!

Table of Contents

- Understanding Your FICO Score

- Why is a 740 FICO Score Considered Good?

- How Does a 740 FICO Score Compare to Others?

- What Can You Achieve with a 740 FICO Score?

- How to Improve Your FICO Score Beyond 740

- Common Misconceptions About Credit Scores

- Real-Life Examples of 740 FICO Score Benefits

- Mastering The Art Of Evaluating Your Google Position

- Finding The Right Divorce Lawyers In Medway A Comprehensive Guide

ficoscorepercentages Attorney Based Credit Repair We use the law

What Does FICO Score 9 Mean? Credello

Understanding Your FICO Score