Meriwest Credit Union: Your Trusted Financial Partner For Growth

Let’s face it, folks—when it comes to managing your finances, you want a partner who truly understands your needs. And that’s where Meriwest Credit Union steps in. As one of the most reliable financial institutions out there, Meriwest has been helping individuals and businesses achieve their financial goals for decades. Whether you're looking to save, invest, or borrow, this credit union has got your back. So, buckle up as we dive deep into what makes Meriwest such a game-changer in the world of finance.

Now, you might be wondering, "What's so special about Meriwest Credit Union?" Well, my friend, the answer lies in its commitment to putting members first. Unlike traditional banks that prioritize profits, Meriwest operates as a not-for-profit organization. This means their focus is on delivering exceptional service and value to their members, not lining the pockets of shareholders. It's a refreshing approach in today's profit-driven world.

But don’t just take my word for it. In this article, we’ll explore everything you need to know about Meriwest Credit Union—from its history and services to the benefits of becoming a member. By the end, you’ll have all the info you need to decide if Meriwest is the right financial partner for you. Let’s get started!

- Unlocking The Secrets Of Google Keyword Ranking Check

- Unlocking The Mystery Discovering What Page Does My Site Rank On Google

Table of Contents

- The History of Meriwest Credit Union

- Key Services Offered by Meriwest

- Becoming a Member of Meriwest

- Benefits of Joining Meriwest Credit Union

- Competitive Rates and Fees

- Meriwest's Commitment to Community

- Cutting-Edge Technology and Security

- Meriwest vs. Traditional Banks

- Frequently Asked Questions

- Wrapping It Up

The History of Meriwest Credit Union

Every great story starts somewhere, and Meriwest Credit Union's journey is no exception. Established way back in 1934, during the height of the Great Depression, Meriwest began as a small credit union serving employees of the Western Meat Company in San Jose, California. Back then, it was known as Western Meat Company Employees Federal Credit Union, but as it grew, so did its name—and its mission.

Fast forward to today, and Meriwest has evolved into a powerhouse financial institution serving over 150,000 members across California. Through the years, they’ve expanded their services, improved their technology, and stayed true to their core values of trust, integrity, and member empowerment. It’s this unwavering dedication that has kept them relevant in an ever-changing financial landscape.

Now, here’s the kicker—Meriwest isn’t just about numbers. They’ve always prioritized building relationships with their members, treating them like family rather than just another account. This personal touch is what sets them apart from the big-name banks out there. And trust me, in today’s fast-paced world, that kind of care goes a long way.

- Discovering Your Digital Footprint How To Find My Rank On Google

- Understanding My Website Rankings A Comprehensive Guide

Meriwest's Growth Over the Years

Let’s break it down a bit more. Over the decades, Meriwest has undergone several mergers and acquisitions, each one strengthening their position in the financial world. In 2011, they merged with Santa Clara Valley Credit Union, which significantly boosted their membership base and expanded their service offerings. Then, in 2016, they acquired San Jose Credit Union, further solidifying their presence in the Bay Area.

These strategic moves weren’t just about getting bigger—they were about getting better. Each merger brought new opportunities to enhance services, improve technology, and reach even more people. Today, Meriwest operates multiple branches throughout California, offering a wide range of products and services tailored to meet the diverse needs of their members.

Key Services Offered by Meriwest

Alright, let’s talk turkey—what exactly does Meriwest Credit Union offer? From savings accounts to loans, they’ve got you covered. Here’s a rundown of some of their most popular services:

- Savings Accounts: Whether you're saving for a rainy day or a dream vacation, Meriwest offers competitive interest rates on their savings accounts.

- Checking Accounts: Enjoy the convenience of a free checking account with no monthly fees and unlimited transactions.

- Loans: Need a car? Want to buy a house? Meriwest offers auto loans, mortgages, personal loans, and more at competitive rates.

- Credit Cards: Their credit cards come with low APRs, no annual fees, and cashback rewards.

- Investment Services: Planning for retirement? Meriwest can help with IRAs, CDs, and other investment options.

What’s cool about Meriwest is that they offer personalized solutions. They understand that everyone’s financial situation is different, so they tailor their services to fit your unique needs. It’s not a one-size-fits-all approach—far from it.

Meriwest Credit Union Loans: A Closer Look

Loans are a big deal, right? Whether you’re buying a car, renovating your home, or consolidating debt, having access to affordable financing can make all the difference. At Meriwest, they offer a variety of loan options designed to help you achieve your goals without breaking the bank.

For instance, their auto loans come with competitive rates and flexible terms, making it easier for you to get behind the wheel of your dream car. And if you’re looking to buy a house, their mortgage programs are designed to help you find the perfect home without the stress. Plus, they offer personalized guidance throughout the process, ensuring you make the best decision for your financial future.

Becoming a Member of Meriwest

So, how do you join the Meriwest family? It’s surprisingly easy. To become a member, you simply need to open a share savings account with a minimum deposit of $5. Yup, that’s it—five bucks gets you in the door. Of course, there are some eligibility requirements, but they’re pretty straightforward.

Traditionally, membership was limited to employees of certain organizations or people living in specific geographic areas. However, thanks to recent expansions, Meriwest now serves a much broader audience. If you live, work, worship, or attend school in one of their designated counties, you’re eligible to join. It’s a win-win situation.

Steps to Join Meriwest Credit Union

Ready to take the plunge? Here’s how you can become a Meriwest member:

- Visit their website and click on the “Join Now” button.

- Fill out the application form with your personal information.

- Make a $5 deposit into a share savings account.

- Voila! You’re now a proud member of Meriwest Credit Union.

See? Easy peasy. Plus, once you’re a member, you’ll have access to all the awesome benefits Meriwest has to offer. It’s like unlocking a whole new world of financial possibilities.

Benefits of Joining Meriwest Credit Union

Alright, let’s talk about the good stuff—the benefits of being a Meriwest member. Here’s why you should consider making the switch:

- Lower Fees: Say goodbye to those pesky bank fees. Meriwest offers free checking accounts with no monthly maintenance charges.

- Higher Interest Rates: Earn more on your savings with Meriwest’s competitive interest rates.

- Personalized Service: Unlike big banks, Meriwest cares about you as an individual, not just a number.

- Community Focus: They reinvest profits back into the community, supporting local causes and initiatives.

- Advanced Technology: Stay connected with their mobile app and online banking platform, giving you 24/7 access to your accounts.

It’s not just about the financial perks either. Being part of Meriwest means being part of a community that truly cares about its members. They host events, offer educational workshops, and provide resources to help you make informed financial decisions.

Why Choose Meriwest Over Other Credit Unions?

Great question. While there are plenty of credit unions out there, Meriwest stands out for a few key reasons. First, their size and scale allow them to offer a wider range of services than smaller credit unions. Second, their commitment to innovation ensures you have access to the latest technology and tools to manage your finances. And third, their long history of excellence speaks for itself.

Plus, let’s not forget about their awesome rewards program. Every time you use your Meriwest debit or credit card, you earn points that can be redeemed for gift cards, travel rewards, and more. Who doesn’t love free stuff, right?

Competitive Rates and Fees

When it comes to rates and fees, Meriwest Credit Union shines. They consistently offer some of the best rates in the industry, whether you’re saving, borrowing, or investing. Let’s take a closer look:

- Savings Rates: Meriwest’s savings accounts boast competitive APYs, helping your money grow faster.

- Loan Rates: Their loan rates are typically lower than traditional banks, saving you money on interest over time.

- Credit Card Rates: With low APRs and no annual fees, their credit cards are a smart choice for everyday spending.

And let’s not forget about fees. Unlike some banks that nickel-and-dime you with hidden charges, Meriwest keeps things transparent. They don’t charge monthly fees for checking accounts, and they offer free ATMs through the CO-OP network. It’s all about keeping more money in your pocket where it belongs.

How Meriwest Saves You Money

Here’s a quick example to illustrate the savings. Let’s say you’re looking to buy a car and need a $20,000 loan. At a traditional bank, you might be stuck with an interest rate of 6%. But at Meriwest, you could get that same loan for as low as 3.99%. Over the life of the loan, that’s a potential savings of thousands of dollars. Not too shabby, huh?

Meriwest's Commitment to Community

At Meriwest, giving back is more than just a slogan—it’s a way of life. They’re deeply involved in the communities they serve, supporting local charities, schools, and non-profits. In fact, they’ve donated millions of dollars over the years to causes ranging from education to homelessness.

But it’s not just about writing checks. Meriwest employees volunteer their time and expertise to help make a difference. From organizing food drives to mentoring students, they’re out there making a positive impact every day. It’s this commitment to community that makes Meriwest more than just a financial institution—it’s a force for good.

Examples of Meriwest's Community Involvement

Here are a few examples of how Meriwest gives back:

- Partnerships with local schools to provide financial literacy programs.

- Supporting organizations like United Way and Habitat for Humanity.

- Hosting annual fundraising events to benefit various causes.

It’s this kind of dedication that sets Meriwest apart from the rest. They truly walk the walk when it comes to community involvement, and it’s something their members can be proud of.

Cutting-Edge Technology and Security

In today’s digital age, having access to advanced technology is a must. And Meriwest delivers in spades. Their mobile app and online banking platform make it easy to manage your finances from anywhere, anytime. Need to check your balance? Transfer funds? Pay a bill? No problem—Meriwest’s got you covered.

But technology is only part of the equation. Security is equally important, and Meriwest takes it very seriously. They employ state-of-the-art encryption and fraud detection systems to protect your information. Plus, their 24/7 monitoring ensures any suspicious activity is flagged immediately.

Features of Meriwest's Mobile App

Here’s a sneak peek at some of the cool features in Meriwest’s mobile app:

- Real

- How To Check My Google Rating And Improve It

- Unlocking The Secrets Of Your Online Presence How To Check Google Website Ranking

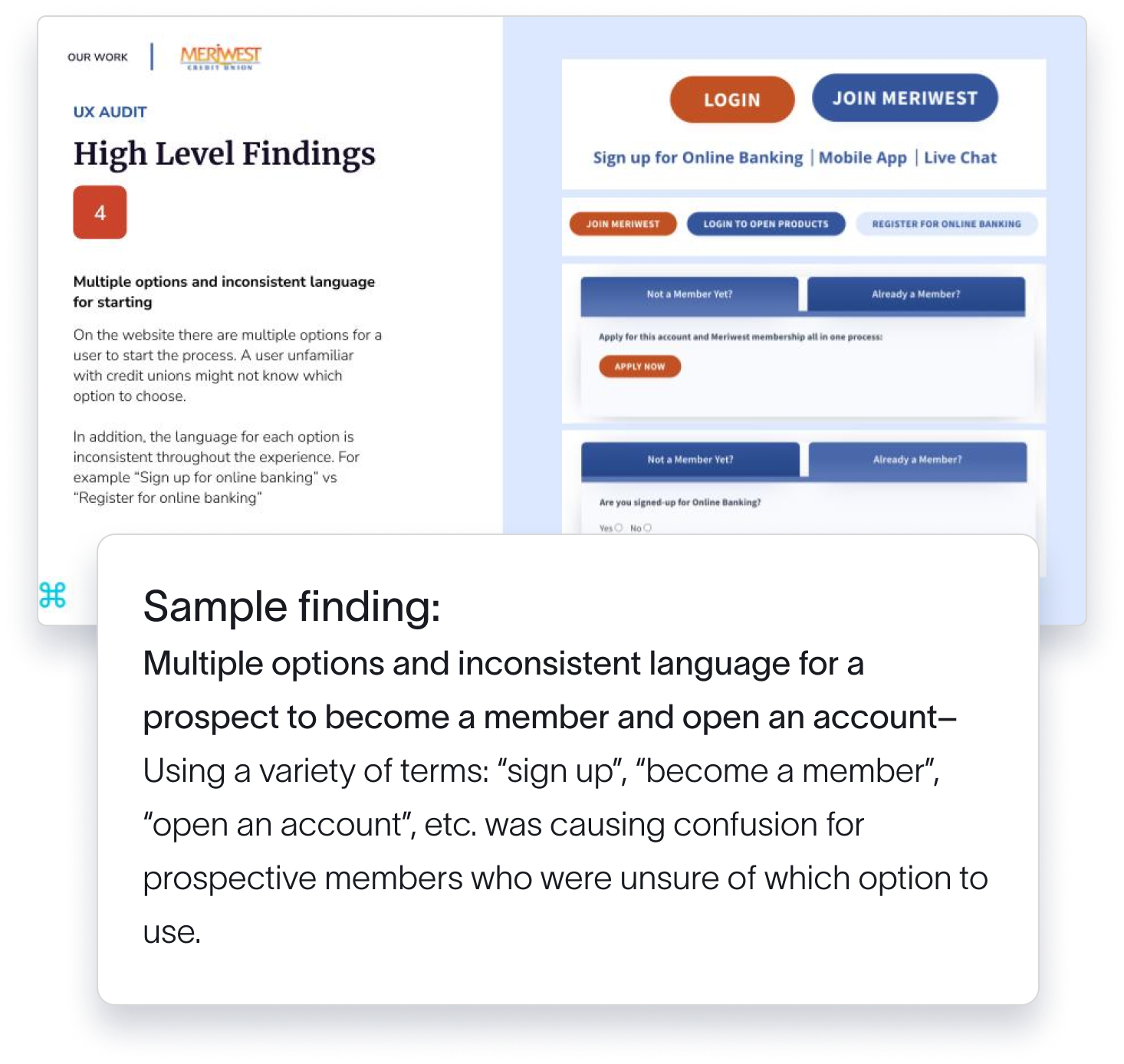

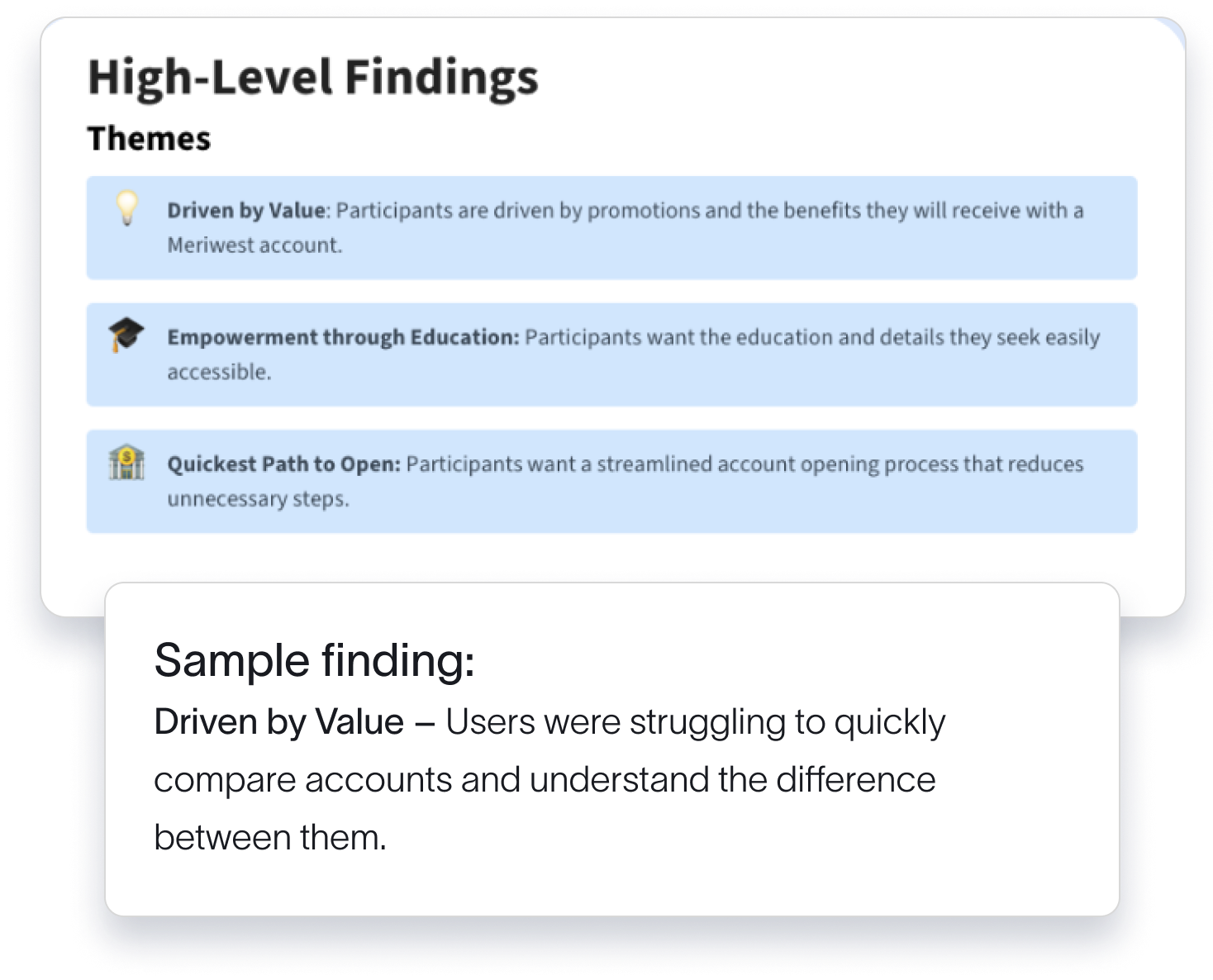

Meriwest Credit Union Praxent

Meriwest Credit Union Praxent

Meriwest Credit Union Praxent